Loading... Please wait...

Loading... Please wait...- Home

- Buy

- Subscribe to DLSUB

-

Info

- DLSUB Match or Beat Any Verified Price

- DLSUB Deliver Here is the Proof

- DLSUB Members Download Every Course in the DLSUB VAULT for Free

- Why DLSUB GOLD ELITE Annual Membership is a No Brainer

- Unlock DLSUB 365K Worth of Learning For Just a Dollar a Day

- DLSUB Members Only Pay $1.49 Per Course

- DLSUB Lifetime Subscription

- Not a DLSUB Member No Problem

- DLSUB Members Get 30 Premium Trading Courses for Just $245

- How DLSUB works

- What Does DLSUB Stand For

- DLSUB Rewards

- DLSUB Dropping Soon

- DLSUB LIFETIME

- DLSUB Refund Policy

- Contact DLSUB

- Sitemap

📩 For Download Links → Email: admin@cashcowtraders.com

Michael Jenkins - Basic Day Trading Techniques

Retail Price: $125

Your Price:

DLSUB Member Price: $0

Michael Jenkins - Basic Day Trading Techniques

Michael Jenkins - Basic Day Trading Techniques

Michael Jenkins - Basic Day Trading Techniques

Michael Jenkins - Basic Day Trading Techniques

Michael Jenkins - Basic Day Trading Techniques

Michael Jenkins - Basic Day Trading Techniques

Michael Jenkins - Basic Day Trading Techniques - Overview and Details

Michael Jenkins - Basic Day Trading Techniques provides traders with a structured introduction to the geometric and time based principles that define Jenkins approach to intraday forecasting. Drawing from decades of institutional experience, Michael Jenkins demonstrates how disciplined structure and mathematical analysis can dramatically improve timing and execution.

This program emphasizes the importance of chart symmetry, proportional price movement, and intraday cycle recognition, helping traders identify high probability opportunities before they unfold. Traders gain a solid foundation for understanding the mechanics of intraday reversals, trend continuation patterns, and precise entry techniques.

Whether you are expanding your technical skillset or diving deeper into the Jenkins methodology, this course offers actionable insights, repeatable frameworks, and tools that can enhance clarity during fast moving market conditions.

Michael Jenkins - Basic Day Trading Techniques - Expert Guidance You Can Trust

✔️ Michael Jenkins is widely respected for his mastery of geometric price forecasting, time cycles, and advanced market analysis techniques used by professional traders.

✔️ His background as a former Wall Street trader provides real world insight into institutional execution, risk control, and disciplined strategy development.

✔️ Jenkins has authored multiple influential works on market geometry, each offering traders a mathematically grounded perspective on timing and directional forecasting.

✔️ His instruction is known for clarity, precision, and focus on universal principles that apply across all market conditions.

Michael Jenkins - Basic Day Trading Techniques - Key Learning Areas

➡️ Learn how market geometry reveals proportional moves, angle relationships, and price symmetry essential for forecasting intraday turning points.

➡️ Explore Jenkins method for identifying time cycles that influence daily reversals and trend exhaustion zones.

➡️ Understand how price to time ratios can signal the end of moves before traditional indicators respond.

➡️ Apply structured entry, exit, and risk management techniques rooted in repeatable mathematical patterns.

Michael Jenkins - Basic Day Trading Techniques - What You Will Gain

✅ Gain a clear and structured understanding of intraday forecasting using Jenkins proprietary geometric techniques.

✅ Strengthen your ability to anticipate turns rather than react, improving confidence and trade timing under fast conditions.

✅ Learn techniques that apply to all markets, offering flexibility whether you trade equities, futures, forex, or indices.

✅ Enhance your chart reading by incorporating geometric structure, symmetry, and price to time analysis.

✅ Build a disciplined trading approach that replaces emotional decision making with mathematically grounded logic.

Michael Jenkins - Basic Day Trading Techniques - Course Outline

☑️ Introduction to Jenkins foundational approach, focusing on chart geometry, proportional price movement, and time cycles.

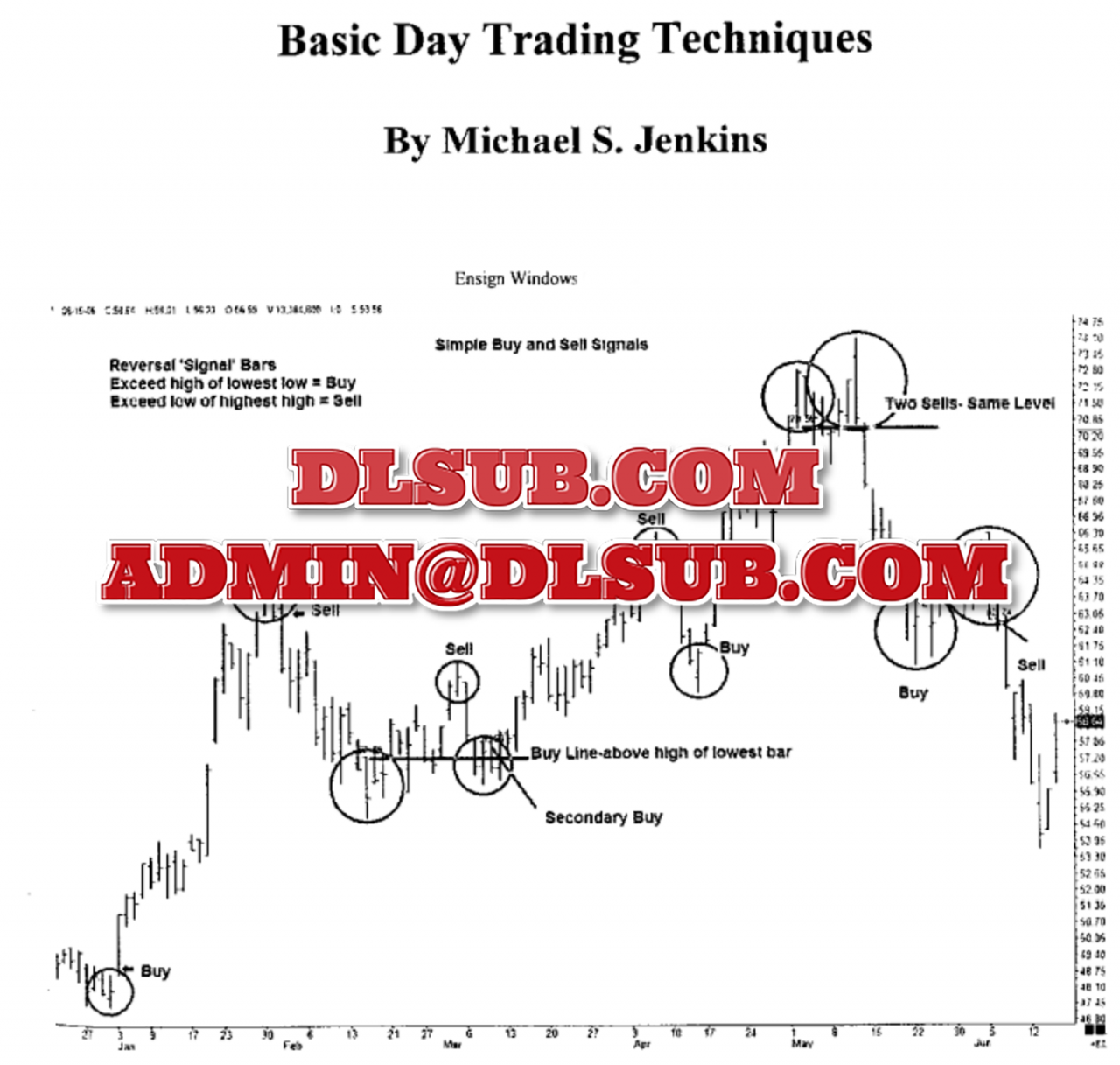

☑️ Step by step breakdown of Gann style angles, vectors, and geometric projections to anticipate intraday market movement.

☑️ Instruction on identifying reversal timing windows and understanding the mechanics behind trend exhaustion.

☑️ Practical study of pattern recognition and price symmetry as key components of high probability setups.

☑️ Detailed exploration of mathematical projections for forecasting likely target zones and turning points.

☑️ Review of trading the open and close, including high probability timing structures and momentum cycles.

☑️ Real chart examples demonstrating the application of Jenkins geometry and time analysis in live trading conditions.

☑️ Final integration of concepts to form a complete intraday trading framework.

Michael Jenkins - Basic Day Trading Techniques - Student Insights

✅ This course helped me understand the deeper structure behind intraday moves, giving me more confidence in my timing and execution.

✅ The geometric explanations made complex concepts easy to apply, improving my precision in identifying high probability setups.

✅ I now approach day trading with a more structured, logical mindset thanks to Jenkins time based techniques.

✅ My trading routine became more systematic and less emotional after applying the principles taught in this program.

Michael Jenkins - Basic Day Trading Techniques - Success Stories

✔️ Traders report improved accuracy as they transition from reactive trading to structured geometric forecasting.

✔️ Students see more consistency by identifying proportional moves and time cycles before market momentum shifts.

✔️ Many traders experience fewer impulsive decisions thanks to the focus on predefined patterns and timing structures.

✔️ Jenkins geometric approach helps traders refine their entries and exits with greater discipline and clarity.

Michael Jenkins - Basic Day Trading Techniques - Your Path to Consistent Trading

✔️ Now is the perfect moment to upgrade your intraday trading with a structured, mathematically grounded methodology proven over decades.

✔️ Avoid random decision making by adopting a precise framework that reveals the natural order behind market movement.

✔️ Strategic learning shortens the trial and error phase, helping you trade with clarity instead of uncertainty.

✔️ Every step you take toward mastering Jenkins geometry and time cycles strengthens your long term trading confidence.

Michael Jenkins - Basic Day Trading Techniques - FAQ

❓ Is this course suitable for beginners?

✔️ Yes, the concepts are introduced in a structured way, making them accessible even if you are new to geometric analysis.

❓ Do I need a large trading account to use these techniques?

✔️ No, the principles apply regardless of account size because they focus on forecasting structure, not position scale.

❓ What markets can this material be applied to?

✔️ The techniques work across equities, indices, futures, and forex due to their universal mathematical foundation.

❓ How long before I notice improvement in my trading?

✔️ Improvement varies, but traders often see greater clarity and discipline as they consistently apply the methods.

Michael Jenkins - Basic Day Trading Techniques - Related Trading Courses